PDRRN PROGRAM TERMS & CONDITIONS

I. GENERAL PROVISIONS

ELIGIBILITY

All individual Beneficiaries of PDRRN

18 to 64 years old, exit age 65

Can actively perform 5 Activities of Daily Living (ADLs) without the help of anybody or anything and in good health, namely:

- Feeding

- Washing

- Dressing

- Toileting

- Transferring

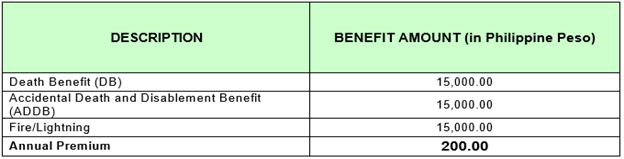

II. MICROINSURANCE PROGRAMS

Life Insurance

The Insurance Company will pay the Death Benefit amount to the beneficiaries designated in the individual application in the event of the Insured Individual’s death.

Incontestability. Except for non-payment of premiums or any other grounds recognized by law or jurisprudence, the Insurer cannot contest the Group Policy or any attached Rider after it has been continuously in force for one (1) year from the Policy Effective Date or from the effective date of the last reinstatement, if any, whichever is later.

No statement relating to the insurability of any Insured Individual may be used in contesting the validity of the Insured Individual’s insurance after it has been continuously in force during the Insured Individual’s lifetime for one (1) year from the effective date of his insurance, unless contained in a written instrument signed by him.

Suicide.The Insurer shall be liable for 10% of the Amount of Insurance if the Insured Individual commits Suicide within the first year from the effective date of his insurance or last reinstatement, if any, whichever is later; provided, however, that the sum insured shall be payable in full after the first year from the effective date of his insurance or last reinstatement, if any, whichever is later, and provided also that Suicide committed in the state of insanity will be compensable regardless of the date of commission.

Where Suicide is not compensable, the liability of the Insurer is limited to the refund of premiums actually received by the Insurer for the current policy year for the Insured Individual, without interest.

EXCLUSION: This policy does not cover loss, cost or expense of whatever nature, directly or indirectly caused by or resulting from pre-existing conditions, unless the Insured Individual has been insured for one (1) year, and thereafter a loss occurs while the coverage is in force.

Pre-existing conditions are defined as those conditions for which the Insured Individual has received medical advice, consultation or treatment by a licensed physician or whose signs or symptoms are evident, or should have been evident to the Insured, even if the Insured did not seek medical advice, consultation or treatment for it prior to the effective date of the Insured Individual’s insurance coverage.

Termination Of Individual Insurance. The insurance of any Principal Insured under the Group Policy terminates automatically upon the earliest of the following dates:

- The date the Group Policy terminates;

- The date the Principal Insured ceases to be an active and bonafide member of the Policyholder;

- The anniversary of the Effective Date of the Group Policy on or immediately following the date he attains exact age sixty-five(65);

- Forty-five (45) days from the end of the period for which premiums are to be paid for the account of such Insured Individual; or

- The date he enters military, air, or naval service; or

- The date a claim of the Principal Insured for Total and Permanent Disability Benefit Rider under the Group Policy is approved, if applicable.

Accidental Death and Disablement Benefit (ADDB) Rider

This Rider shall provide benefits for bodily injuries effected directly or independently of all other causes, through external, violent, and accidental means. This Rider shall also provide benefits for bodily injuries caused by food poisoning, animal bites (except mosquito bites), and Acts of Nature.

Coverage with respect to flying shall be limited to loss occurring while the Insured Individual is riding solely as a passenger, not as an operator or crew member, in boarding or alighting from a certified passenger aircraft provided by a regularly established airline on any regular, scheduled or non-scheduled, special or chartered flight, and operated by a duly licensed pilot flying over an established aerial route between duly established and maintained airports.

This Rider shall not provide benefits for the following persons: Detectives, Secret Service Personnel, Miners, Underground Workers, and Explosive Makers.

If within one hundred eighty (180) days from the date of the Accident, such Injuries shall result in any of the following losses to the Insured Individual, the Insurer will pay for:

Schedule of Indemnities in Percentage of the Amount of Insurance for this Rider:

| Percentage of Amount of Insurance | |

| Death | 100% |

| Disablement of Both Hands or both feet or sight of both eyes | 100% |

| Disablement of One Hand and one foot or either hand or foot and sight of one eye | 100% |

| Disablement of One Hand or one foot or sight of one eye | 50% |

“Accident” means any unintentional act or unforeseen, unusual, and unexpected event which directly causes an Injury or death.

“Injuries” means bodily injuries that

- are sustained while This Group Plan is in force;

- are caused solely by external, violent, and accidental means and independent of any other cause; and

- produce a visible contusion or wound on the exterior of the body except in the case of drowning or of internal injury revealed by an autopsy.

“Acts of Nature” shall refer to earthquake, seaquake, tidal waves, volcanic eruption, typhoon, hurricane, flood, windstorm, hailstorm, rainstorm, tornado, or other catastrophe brought about by nature.

“Loss of Use” means the complete and permanent inability of the Insured Individual to move or perform an action for which his limbs, fingers, toes or metacarpals are normally fitted or used, or for which they normally exist. It includes paralysis, which means complete and permanent inability to move as a result of neurological damage.

“Disablement” means complete and permanent severance of any of the following: (a) hand – at the wrist and (b) foot - at the ankle joint.

Total and permanent disability shall mean uninterrupted disability for not less than six (6) months, which prevents the Insured Individual from engaging in any gainful occupation, employment, or business. This Group Plan must be continuously in force from the inception of the sickness or injury causing the total and permanent disability to the commencement of the total and permanent disability itself.

The loss of the first joint of the thumb or any other finger or of any toe shall be considered as equal to the loss of one half of the thumb or finger or toe and the benefit shall be one half of the benefit specified in the above schedule of indemnities for the loss of the thumb or finger or toe. The loss of more than one phalanx of the thumb or of any other finger or of any toe shall be treated as loss of the entire thumb or finger or toe. Where there is loss of two or more parts of the hand, however, the percentage payable shall not be more than the loss of the whole hand.

Where the percentage of the Amount of Insurance for Dismemberment or Loss of Use is not specified in the above schedule of indemnities, the Insurer will adopt a percentage of the Amount of Insurance, which is not inconsistent with the provisions of the above table.

The total of the benefits for any one (1) Accident resulting to death or disablement within 180 days from the date of the Accident shall not exceed the Amount of Insurance for any Insured Individual.

The total of the benefits for any one term of coverage resulting to Loss of Use, Dismemberment or disablement shall not exceed the Amount of Insurance for any Insured Individual. Such payment of benefits shall not terminate This Group Plan in so far as the benefit for Death is concerned. In any one term of coverage, the benefit payable for death arising from an independent and unrelated Accident shall be the Amount of Insurance.

Any partial benefit already paid for any loss shall not be carried over in the subsequent term of coverage

Murder and Assault. The Rider shall cover losses caused by the risks of murder, assault, or any such attempt provided that such risks:

1. shall not have been provoked by the Insured Individual; and

2. shall not have happened while the Insured Individual is a) engaging in political activities, or b) performing investigative, security or political function, or c) holding any elective governmental position.

There shall be no Murder & Assault coverage for Security Guards.

The maximum liability of the Insurer for loss caused by murder or assault is deemed limited to the Amount of Insurance for this Rider, as specified in the Group Policy.

Motorcycling Coverage Clause.The insurance afforded by this proposal shall apply while the Insured is riding or operating any motorized two-wheeled vehicle EXCEPT while such vehicle is being used for any race, speed test or exhibition, or when the Insured is under the influence of liquor, narcotics, or prohibited drugs.

Aggregate Limit of Liability. The Insurer shall not be liable for any amount in excess of the Aggregate Limit of Liability for any one (1) Accident under this Rider, as specified in the Group Policy Data. If the aggregate amount of all indemnities otherwise payable by reason of coverage provided under this Rider exceeds the Aggregate Limit of Liability, the Amount of Insurance payable with respect to each Insured Individual shall be proportionately reduced until the aggregate amount of all indemnities does not exceed the Aggregate Limit of Liability.

Exclusions.This Rider does not cover losses, costs, or expenses of whatever nature, directly or indirectly caused by or resulting from any one of the following:

1) Intentionally self-inflicted injuries, suicide, or any attempt thereat, while sane or insane;

2) Any bodily or mental infirmity, disease or sickness, or infection other than infection occurring at the same time with or because of an accidental cut or wound. This exclusion does not apply to Daily Sickness Hospital Benefit, if attached;

3) Murder, assault, or any attempt thereat, except as specifically provided under the Murder and Assault Provision;

4) Losses incurred while performing his duties as a member of the Armed Forces, including those of escort and security services rendered in whatever capacity or form;

5) War, invasion, act of foreign enemy, hostilities or warlike operations (whether war be declared or not), civil war, mutiny, rebellion, revolution, insurrection, military or usurped power, civil commotion assuming the proportion of or amounting to a popular uprising. This exclusion shall not be affected by any endorsement which does not specifically refer to it in whole or in part;

6) Poison, gas, or fumes voluntarily taken, or any nuclear reaction, nuclear radiation or radioactive contamination, and chemical or biological contamination. For the purposes of this exclusion, “contamination” means the contamination or poisoning of people by nuclear and/or chemical and/or biological substances which cause illness and/or disablement and/or death;

7) Accident occurring while the Insured Individual is operating or learning to operate or serving as a crew member of an aircraft or seacraft;

8) Accident occurring while the Insured Individual is engaged in any dangerous sports or hobbies such as racing on wheels, glider flying, sailing, or other hobbies which are comparably dangerous and risky unless sports premium is paid to cover such risk;

9) Accident caused by the effect of alcohol or any unprescribed drug on the Insured Individual;

10) Any violation or attempted violation of the law or resistance to arrest by the Insured Individual;

11) Cosmetic or plastic surgery, any dental work, treatment or surgery, eye or ear examination, except to the extent that any of them is necessary for the repair or alleviation of damage to the Insured’s person caused solely by Accident;

12) Accident occurring while the Insured Individual is performing the duties of his profession: Acrobat, Asylum Attendant, Aviator, Boilerman, Policeman;

13) Accident to any of the following persons: Divers while performing underwater activities; Firemen while performing fire-fighting activities; and

14) Any Act of Terrorism or any action taken in controlling, preventing, suppressing, or in any way relating to, any act of terrorism. For the purpose of this exclusion, an“Act of Terrorism” means an act, including but not limited to, the use of force or violence, atomic/ biological/ chemical weapons, weapons of mass destruction, disruption or subversion of communication and information systems infrastructure and/or the contents thereof, sabotage or any other means to cause or intended to cause harm of whatever nature and/or the threat of any of the aforementioned acts, of any person or group(s), whether acting alone or in behalf of or in connection with any organization(s) or government(s), committed for political, religious, ideological, or similar purposes including the intention to influence any government and/or to put the public, or any section of the public, in fear.

Automatic Termination. The insurance of an Insured Individual under this Rider shall automatically terminate and its premium shall cease to be payable in any of the following instances:

a) The Insured Individual is declared insane by a competent authority;

b) Upon accidental death of the Insured Individual as provided herein;

c) The Group Policy expires or is terminated for a valid cause, as provided in the Termination of Group Policy provisions in the Group Policy; or

d) The insurance coverage of an Insured Individual is terminated, as provided in the applicable provisions in the Group Policy.

Upon termination of this Rider, the Insurer has no more liability whatsoever under this Rider, except to return any unused premium paid for this Rider, without interest. Termination of this Rider shall not affect any claims arising prior to the effective date of such termination.

PROPERTY ASSISTANCE

Cash Assistance in the event of a loss or damage to the Covered Property resulting from a peril insured against.

The Contract applies only to a loss caused by the Peril Insured against which occurs during the Period of Cover stated in the Schedule.

COVERED PROPERTY

Covered Property for which a Limit of Cash Assistance is shown in the Schedule and as used in the contract means building and its improvements, where the Insured resides.

DEDUCTIBLE

None

PERIL COVERED

FIRE/LIGHTNING

Requisite elements of a covered fire incident:

- Presence of an actual flame or glow

- One that goes out beyond its intended purpose

- Caused accidental damage to covered property

- Fire as the proximate cause of loss and damage

EXCLUSIONS

- Loss or damage occasioned by or through or in consequence, directly or indirectly by any of the following:

- War, invasion, act of foreign enemy, hostilities, or warlike operations, civil war

- Mutiny, riot, military or popular uprising, insurrection, rebellion, revolution, military or usurped power

- Loss or damage directly or indirectly caused by or contributed to by or arising from ionizing radiation or contamination by radioactivity from any nuclear fuel or from any nuclear waste.

- Loss or damage occasioned by or through or in consequence of the burning of the property by order of any public authority.

LIMIT OF BENEFIT

The Insurer shall not be liable in any one loss for any one covered property for more than the amount of cash assistance indicated in the Schedule. In the event that several Insureds reside in the same covered property, the cash assistance shall be limited to the total aggregate amount of cash assistance as indicated in the Schedule.

Underwritten by:

Pioneer Life Inc.

Pioneer House Makati, 108 Paseo de Roxas, Legazpi Village, 1229 Makati City

Tel: +63 2 8812 7777 ●Fax: +63 2 8817 146